√1000以上 mw 507 personal exemptions worksheet 629271-Mw 507 personal exemptions worksheet help

2

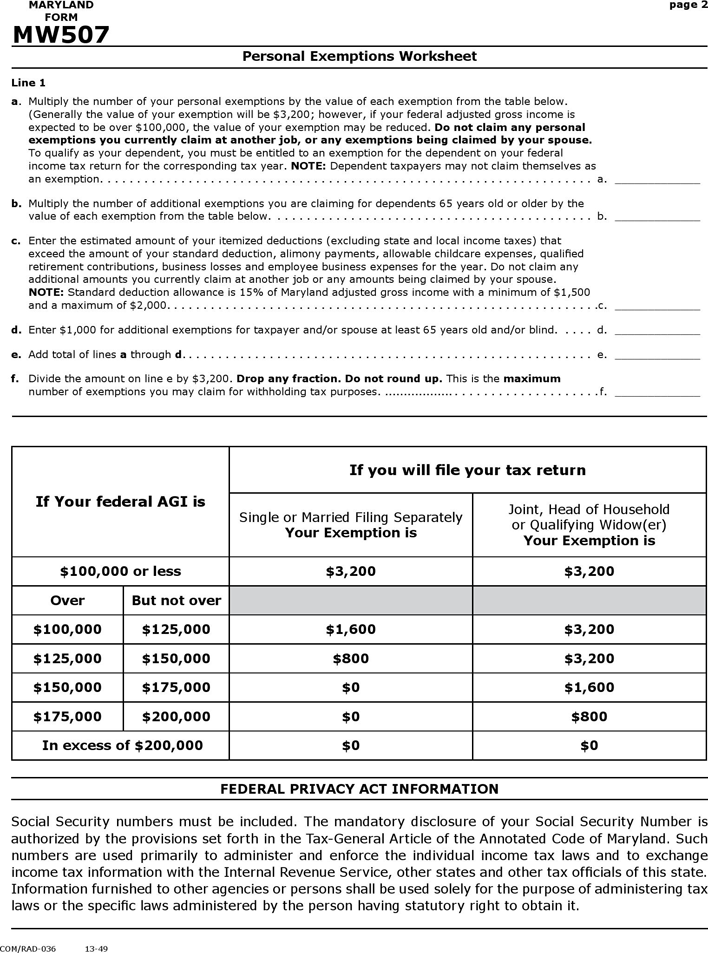

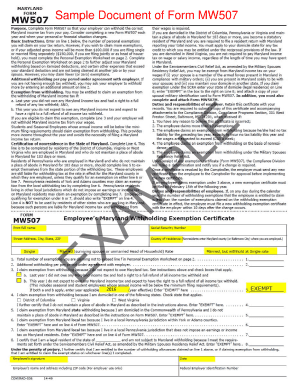

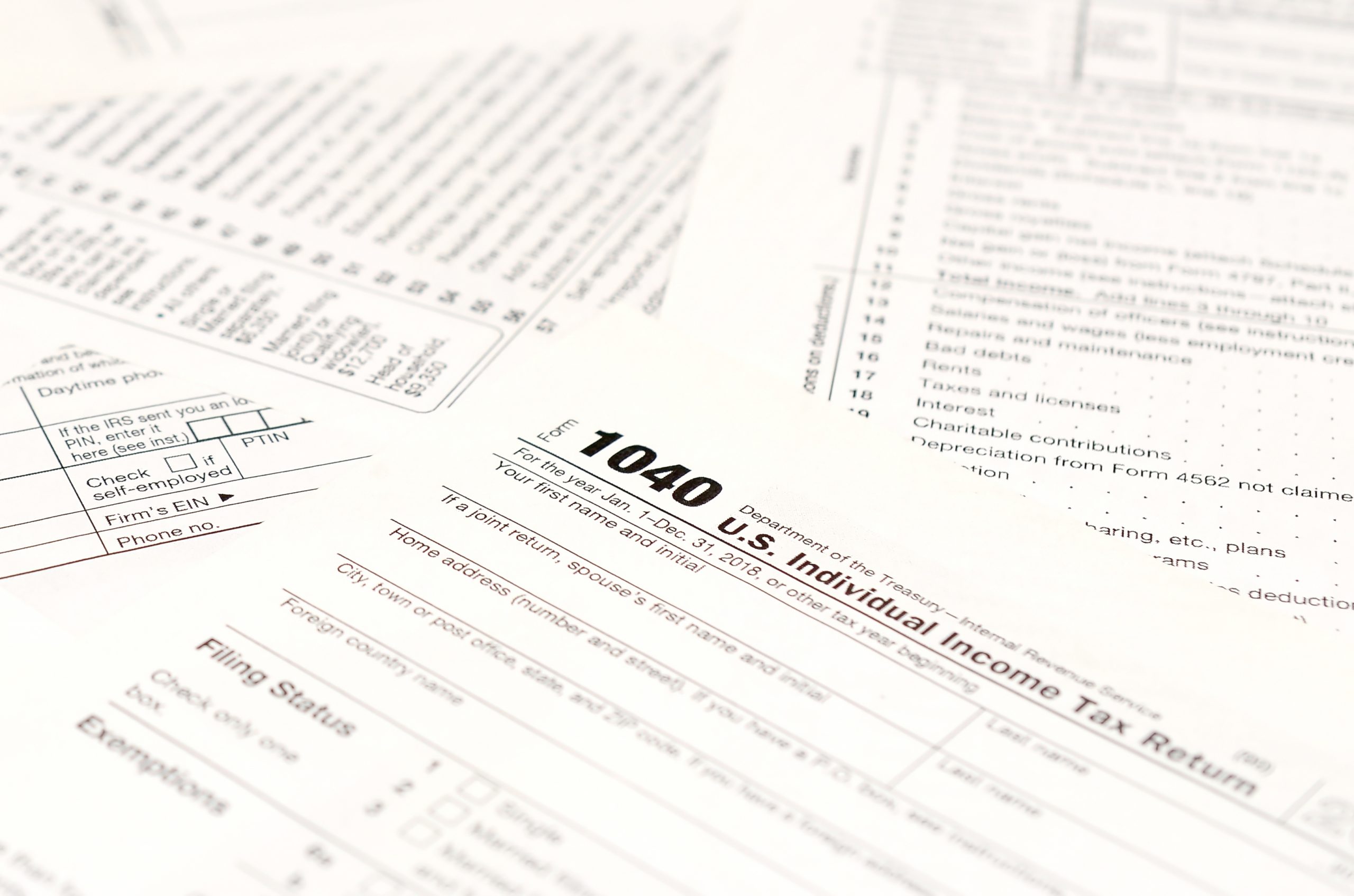

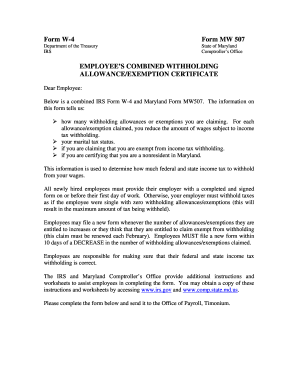

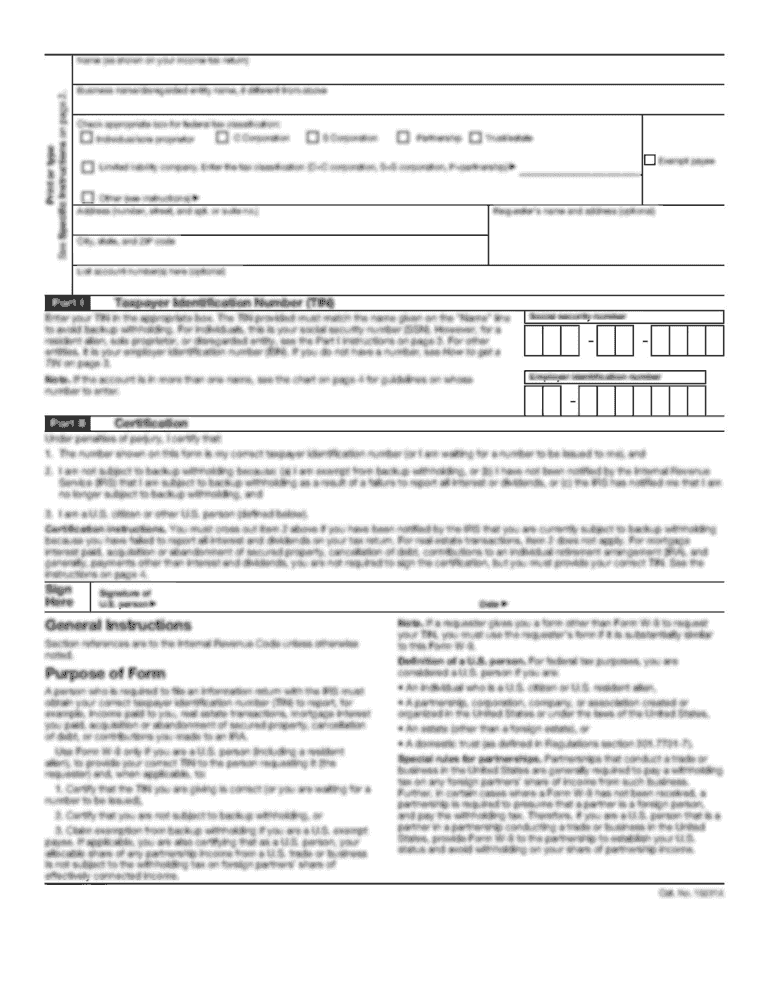

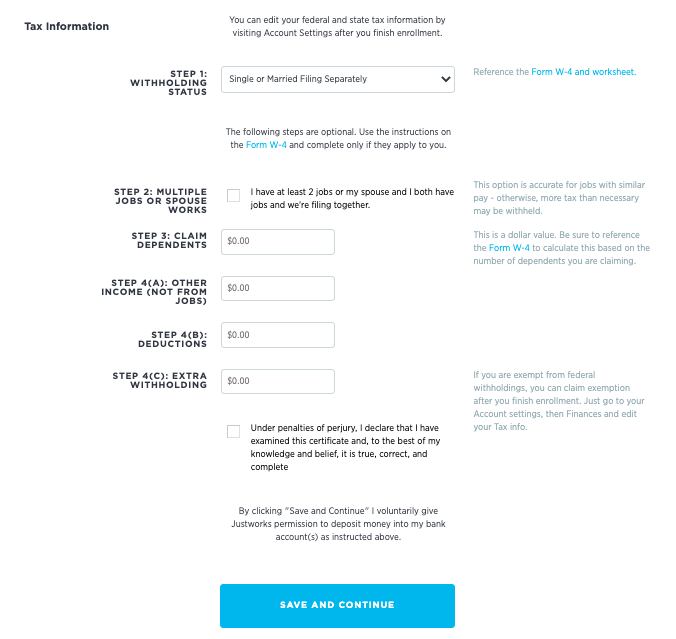

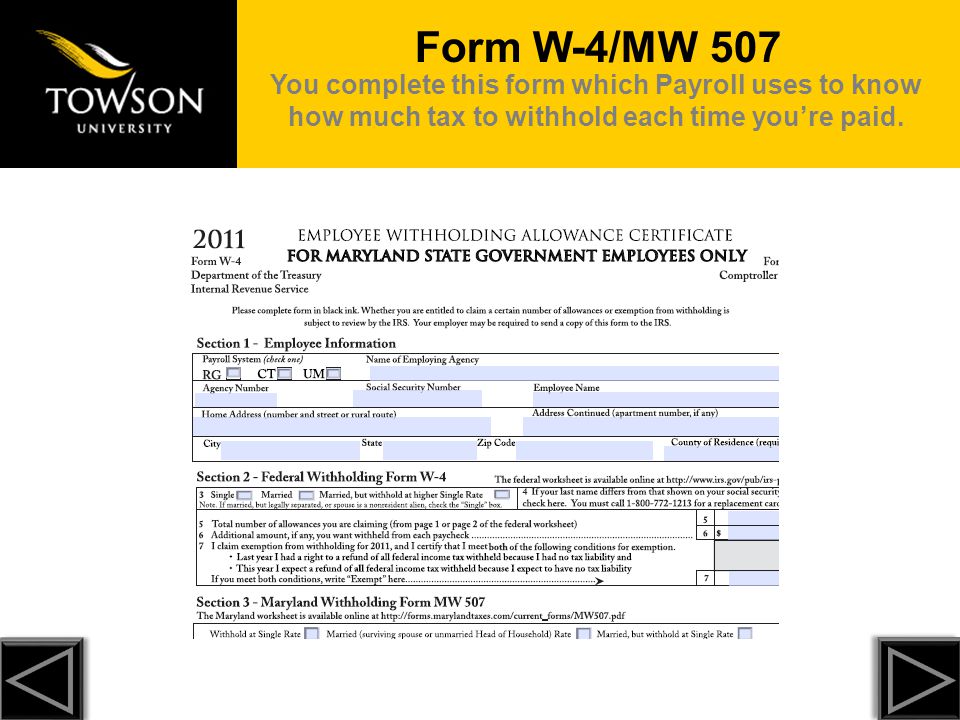

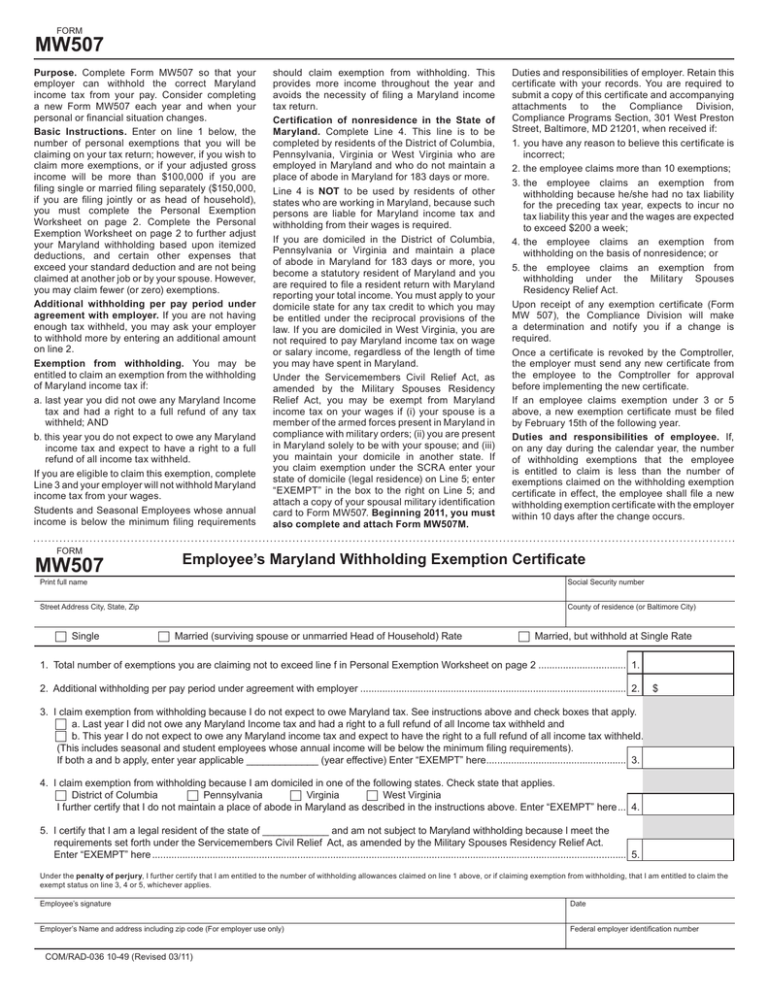

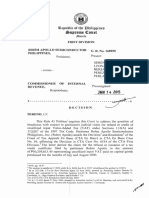

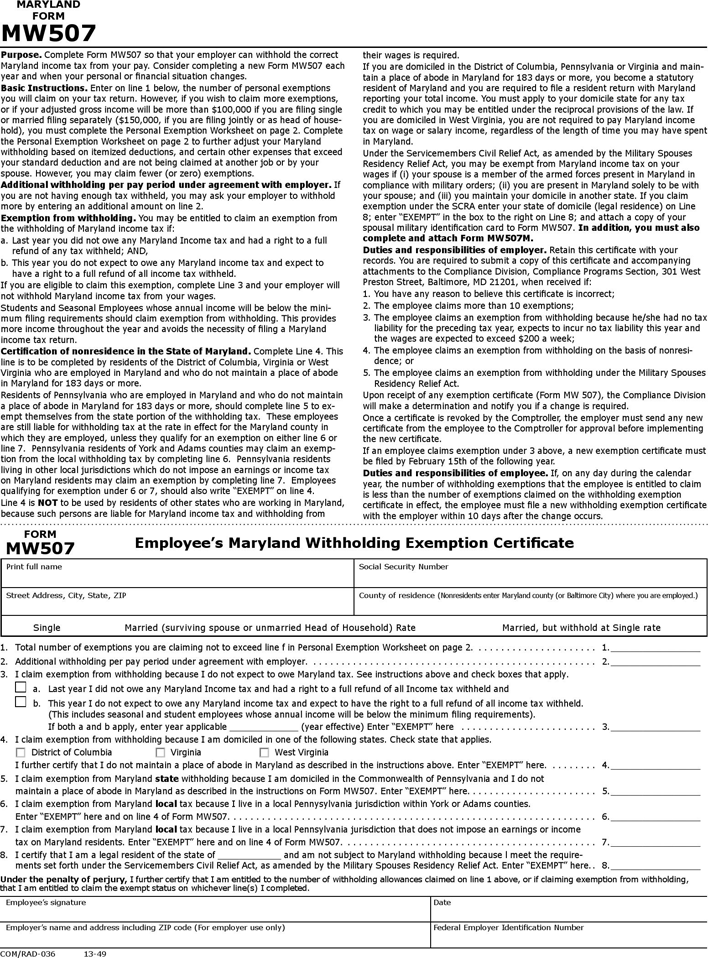

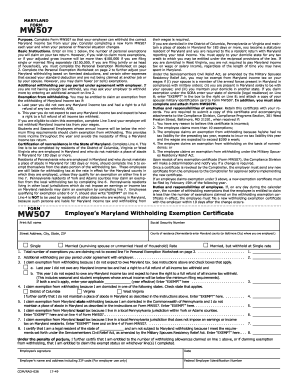

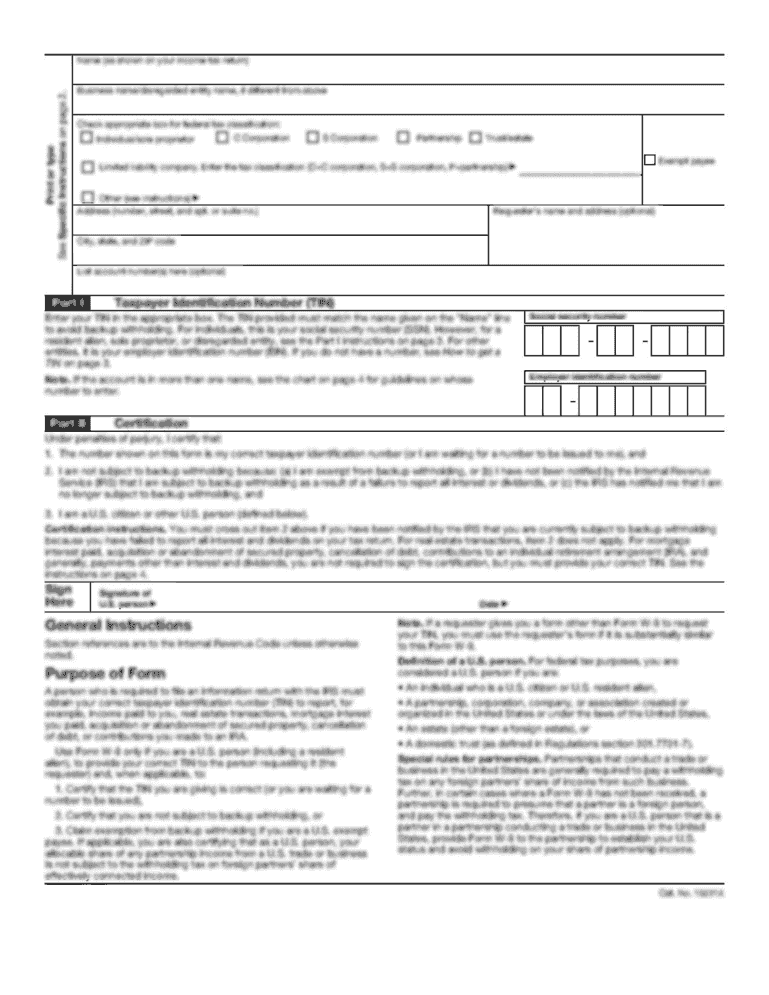

However, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reducedForm MW507 Calculate Employee's Withholding Exemptions You can learn quite a bit about the state's withholding form requirements and still not stumble upon one of the very first forms you'll need to set up your Maryland payroll Form MW507 This is the worksheet form that your employee will need to fill out so that you can calculate the estimated income tax to withhold from

Mw 507 personal exemptions worksheet help

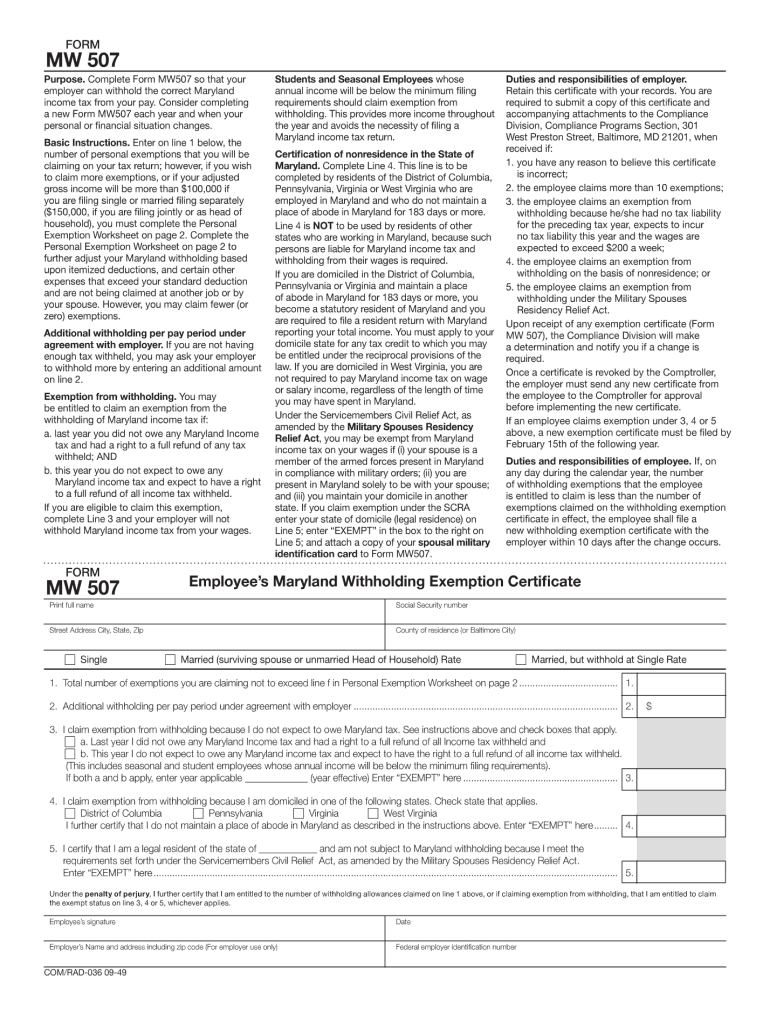

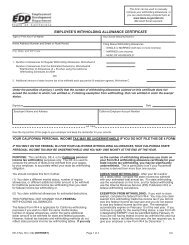

Mw 507 personal exemptions worksheet help-However, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reduced Do not claim any personalPersonal Exemptions Worksheet Line 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;

2

MW 507 Personal Exemptions Worksheet Line I a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;MW507 Instructions Complete all the fields of the general information section (Name, Social Security Number if any, Address, and County) Mark single due to nonresident alien tax status, even if married Line 1 Complete line 1 using the worksheet on page 2 (Most international employees use the same number on the Federal W4 line 5)Fill out MW507 MW507 The Comptroller Of Maryland in a few clicks following the recommendations below Choose the template you require in the library of legal forms Select the Get form button to open the document and begin editing Fill out the requested fields (these are yellowcolored)

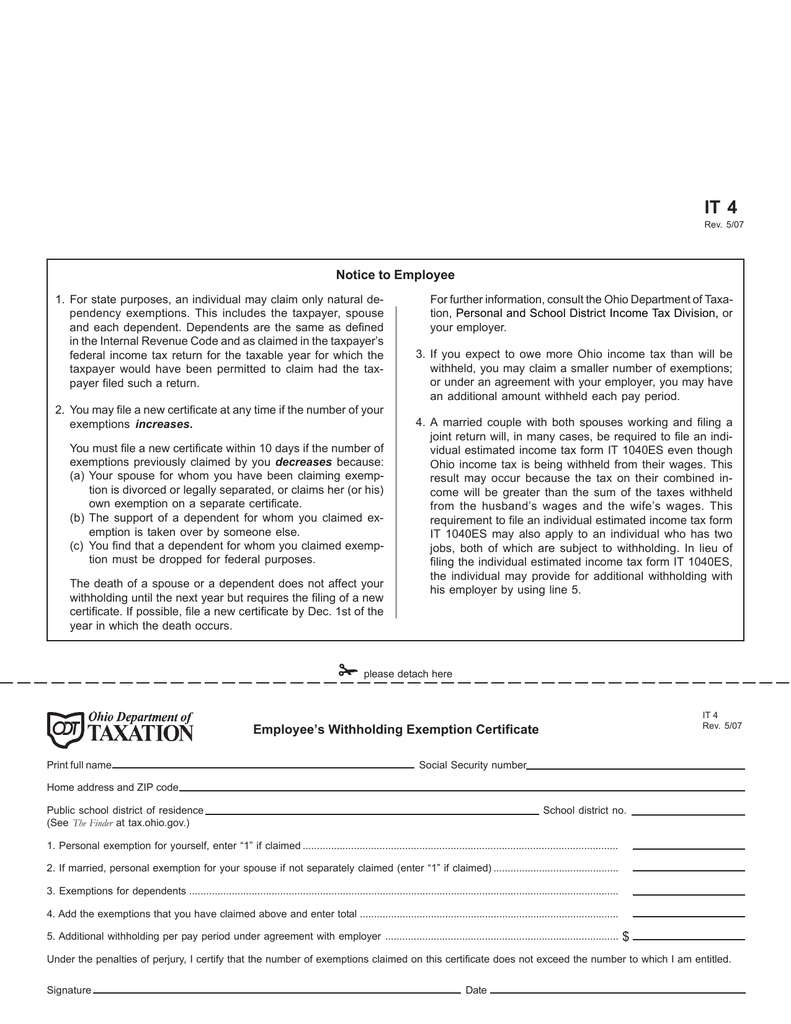

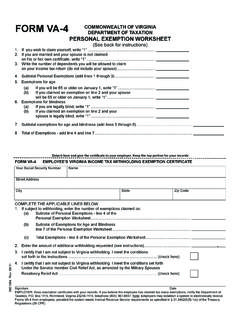

Please complete form in black ink Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the IRS Your employer may be required to send a copy of this form to the IRS Form MW 507 Comptroller of Maryland 19 Form W4 Department of the Treasury Internal Revenue ServiceNumber of personal exemptions (total exemptions on lines A, C and D of the federal W4 or W4A worksheet)a _____ b Number of additional exemptions for dependents over 65 years of age b _____ c Number of additional exemption for certain items, including estimated itemized deductions, alimony payments,Learn how to fill out MW507 personal exemptions worksheet without making any mistake The Maryland Form MW 507 is the Employee's Maryland Withholding Exemption Certificate The MW507 form must be completed so that you know how much state income tax to withhold from your new employee › Verified 6 days ago

Mw 507 personal exemptions worksheet helpのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

2 |  2 | 2 |

2 |  2 | 2 |

2 | 2 | 2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 |  2 |  2 |

2 |  2 |  2 |

2 | 2 |  2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 | 2 | 2 |

2 |  2 | 2 |

2 |  2 | 2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 | 2 | /ScreenShot2021-02-05at6.15.36PM-5e31046e8de14a21a3719fd399a682b3.png) 2 |

2 | 2 | 2 |

2 | 2 |  2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 | 2 | 2 |

2 | 2 |  2 |

2 | 2 | 2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 | 2 | 2 |

2 | 2 | 2 |

2 | 2 | 2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 | 2 | 2 |

2 | 2 | 2 |

2 | 2 | 2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 |  2 |  2 |

2 |  2 |  2 |

2 | 2 | 2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 | 2 | 2 |

2 | 2 |  2 |

2 | 2 |  2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 |  2 |  2 |

2 |  2 | 2 |

2 |  2 |  2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 |  2 | 2 |

2 |  2 | 2 |

2 | 2 | 2 |

「Mw 507 personal exemptions worksheet help」の画像ギャラリー、詳細は各画像をクリックしてください。

2 |  2 |  2 |

2 |  2 |

However, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reduced Complete the Personal Exemption Worksheet on page 2 to further adjust your Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deduction and are not being claimed at another job or by your spouse However, you may claim fewer (or zero) exemptions

Incoming Term: mw 507 personal exemptions worksheet help,

コメント

コメントを投稿